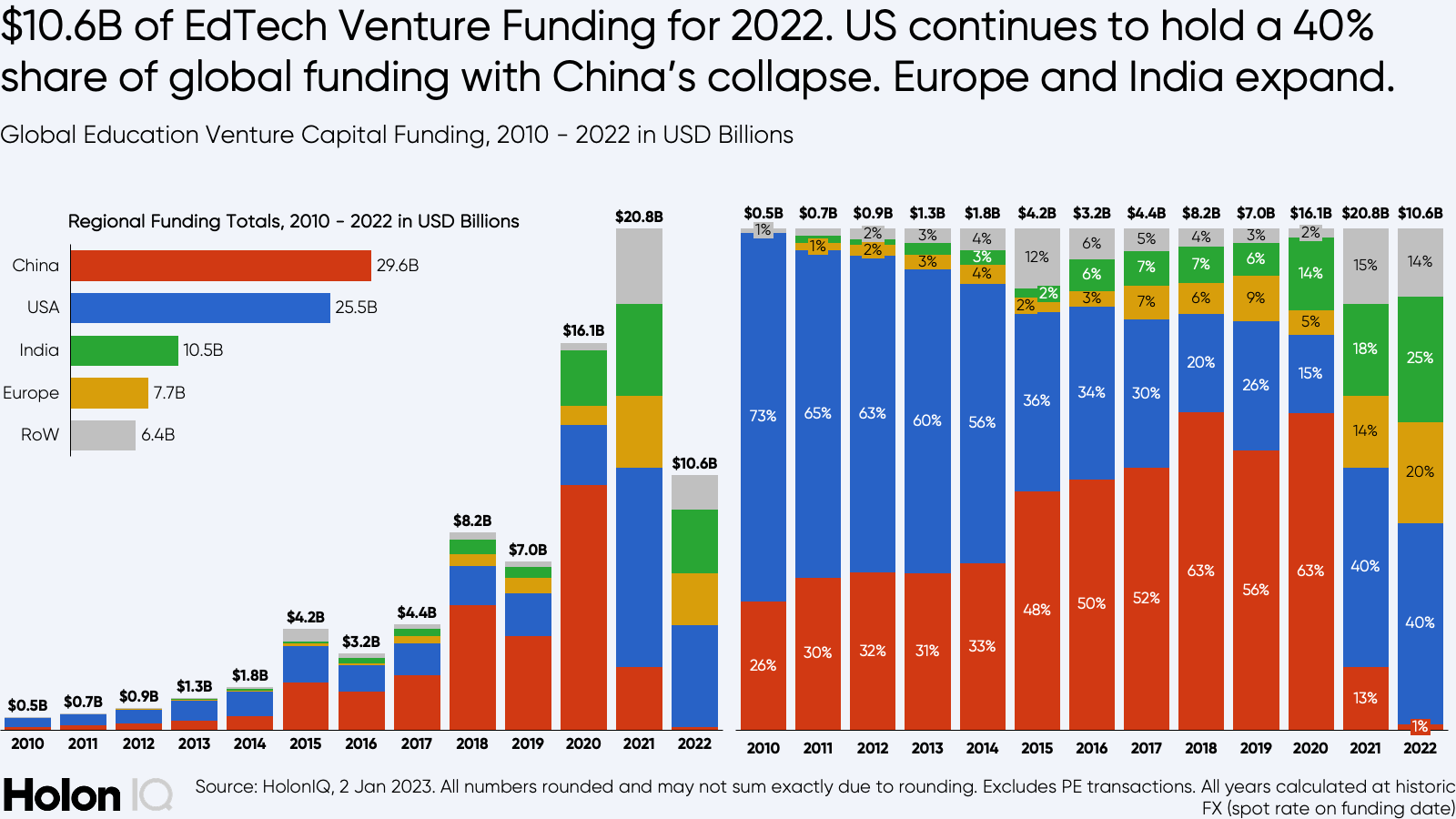

Global EdTech Venture Capital had a strong 2022 delivering $10.6B of investment, albeit 49% down on 2021's record levels. Expect 2023 to moderate back to pre-pandemic levels with growth in the US, Europe and India replacing China's six year run before COVID delivering more than 50% of global funding in EdTech.

On pre-pandemic standards, EdTech VC had a massive year in 2022. But alongside the biggest boom in venture funding's history (2020-2021), the party's over and it's back to fundamentals and outcomes. With innovation surging across the entire EdTech Landscape notable mega rounds in 2022 included 🇮🇳 BYJU'S ongoing funding spree, 🇦🇹 GoStudent‘s $340M Series D, 🇺🇸 Paper's $270M Series D, 🇺🇸 Guild's $270M growth round, 🇮🇳 UpGrad's $225M growth round, 🇬🇧 Multiverse's $220M Series D, 🇩🇪 CoachHub's $200M Series C and 🇺🇸 Handshake's $200M Series F to name a few of the larger deals that dominated the first half as the second faded away month by month.

2022 closed with 30 EdTech Unicorns around the world, collectively valued at $89B. 6 EdTech Unicorns joined the list through 2022 and HolonIQ removed 12 companies from the list in our annual review (2 Jan 2023), assessed as 'lapsed' based on 5 years or greater since the last priced equity round or in the case of Chinese Unicorns, companies that in our view require a publicly disclosed equity round following major regulatory changes to rejoin the list. There were no EdTech Unicorn exits in 2022 and 2023 will prove a challenging exit environment at this stage.

In a 'Mark to Market' scenario, where Dec 2022 consensus valuation multiples are used to 're-price' the last round of each of the 30 EdTech Unicorn's, we note this list would likely further reduce by 25-50%, perhaps more.

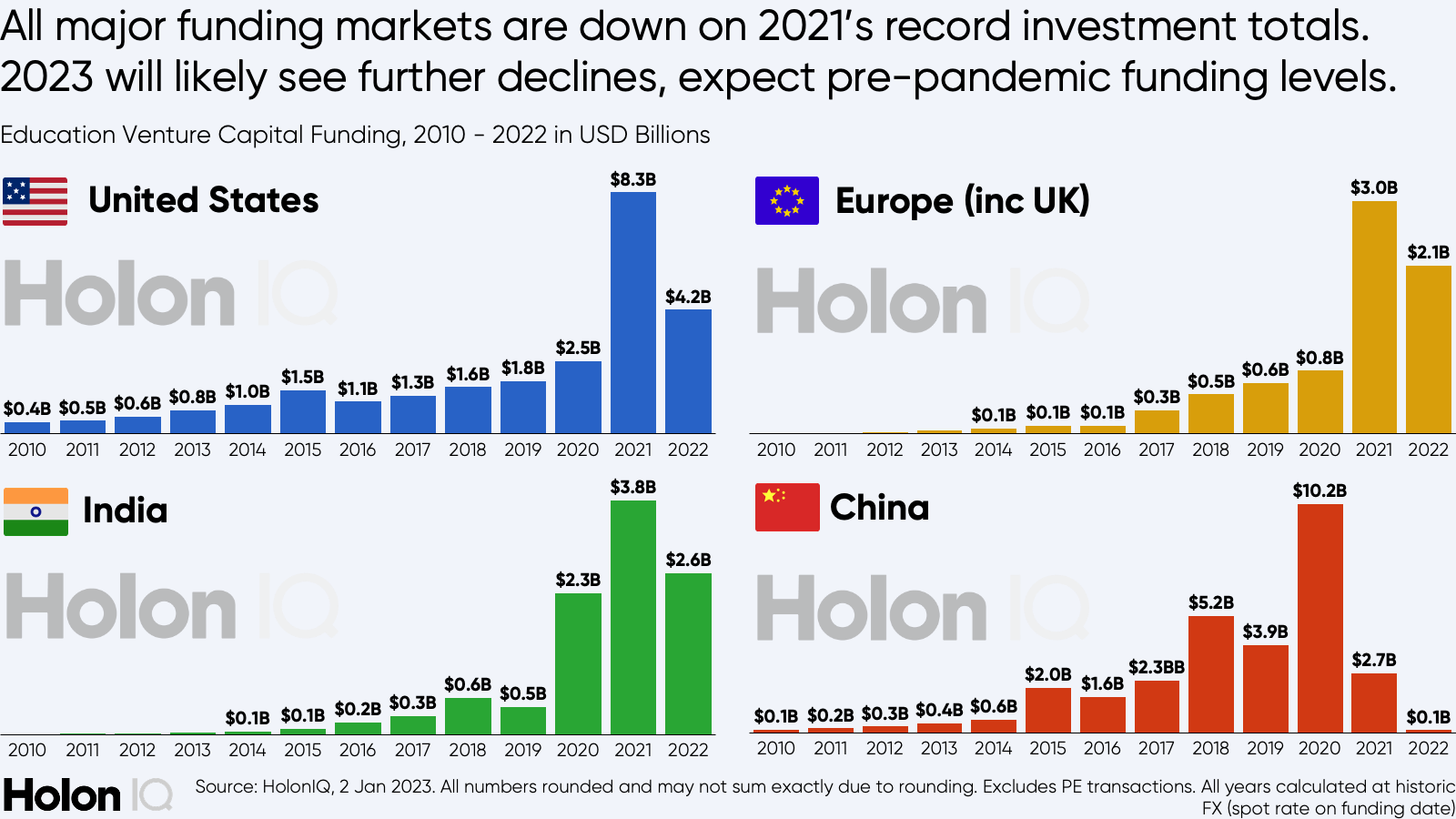

Figure 1

The major change in EdTech VC through the pandemic was the withdrawal of Chinese investors from the market, so much so that 2022 saw less Chinese VC than a decade ago. Meanwhile, the US delivered massive VC funding growth in all industries, and EdTech was no different. Indeed the pandemic brought EdTech to the attention of mainstream investors who no doubt helped take valuations to new highs and due diligence timeframes to new lows. Excited by the transformational potential of technology in education, but unfamiliar with the risks and challenges of innovation in learning and teaching, the broader investor base drove EdTech investment to surge in 2021, nearly triple that of 2019 and as 2022 progressed, the market flipped and investment slowed to a crawl.

Europe and India have both grown EdTech VC investment significantly over the the last few years, however in both cases in addition to a broader and higher quality base of early stage startups, the large investment levels are principally driven by a few outliers that may or may not be repeatable over the next 2-3 years. Beyond the major funding markets, we've seen further expansion and scale across Africa, Latin America, the Middle East, Southeast Asia and Oceania as local leaders scale to fulfill gaps in their home markets and find new customers around the world.

Beyond geographic changes in funding, the rise and moderation of mega-rounds explains much of the the structural changes to the market. 2021's record was driven primarily by over 50 mega rounds (> $100M) with 18 of those rounds greater than $250M. 2022 delivered an overall fall in VC funding rounds greater than $50M, however the level of investment in $20-50M rounds and below has increased consistently year over year and continued to do so in 2022.

Figure 2

.png)